29 Nov Always Get Paid in Advance: The Service Provider’s Legal Toolkit

We represent service providers of all types: software developers, commercial photographers, graphic designers, I.T. firms, and many more. The single most common piece of legal advice I give them is: always get paid in advance. Require your clients to pay at least a portion of your expected total fees before you start work. It’s not a complicated strategy, but it’s critical and serves multiple goals at once. And you’d be amazed how many entrepreneurs don’t do it. So let’s explore why this is important, and then review ways you can use your client contracts to make it happen.

Why you should require advance payment

Screen out risky clients. One key to growing a service business is quickly identifying and declining work from people who present financial risks for you. Not all who promise to pay ultimately do pay. The new client who cannot make a small payment today probably will have an even harder time paying your larger invoices later. Far better to identify these problem payers before taking them on as a client. It’s much trickier when you first learn of their non-paying tendencies after you’ve spent a month working for them.

Validate the mechanics of payment. Advance payments give you early warnings of any procedural issues that can delay your future invoices. Sometimes it turns out that the person who signed your contract on the client’s behalf does not have authority to cut a check. Or maybe they thought they could give you net-30 payment terms, but they didn’t realize their company only does net-60. And the first time you take on a client in a foreign country, you realize how long international payments can take and the fees they entail. None of these issues mean you should turn down the work, but they sometimes may affect how you do that work — so best to spot them early.

Reduce risks of uncompensated work. As a service provider, you will have clients from time to time who just don’t pay their bills. It’s an inherent business risk. So design your sales –> screening –> onboarding funnel to minimize those losses. Requiring payment upon signing your contract guarantees at least partial compensation for your first month of work.

Cash flow. Most businesses both pay money out and take money in each month. You’re paying money out for your employees or sub-contractors, your website and CRM software, your office or coworking space membership, and more. Take money in regularly so you can pay it out regularly.

How to write your contracts to take advance payment

So how do you actually write your request for advance payment into your standard client agreement? Start by identifying the times and amounts of payments that you’d like to receive. Some service providers require 100% payment in advance; that’s fine, but most clients, understandably, won’t agree to it. Other common arrangements include:

- 25% or 50% of total fees due at the time of signing the agreement. This is common for shorter, one-off projects with a fairly certain begin and end date, like contracts for wedding photography, event catering, or graphic design.

- One or two months’ worth of monthly project fees. This makes sense for longer projects that may have uncertain end dates but entail monthly fees, like large software development projects, or projects that are intended to be indefinite.

One tip for website developers, software development firms and managed I.T. firms: as you’re deciding how much of an advance payment to require, consider the amounts that you’ll want to cover if the new client terminates the contract shortly after hiring you. Depending on how you work, this could include the costs of any third-party software licenses you may have just purchased for the new client (especially important if you’re a reseller of third-party software and just bought a one-year subscription for the new client). This could also include opportunity costs: if you just turned down a second lucrative new client so you could assign two developers to this new client, then the loss of the new client means you’re left with two developers earning a salary and not bringing in revenue. So your advance fee should reflect the need to cover a month or two of personnel not earning the client’s revenue.

Whatever approach you take, either (1) make clear that the advance payments are nonrefundable or (2) clearly identify the situations in which refunds will be given.

Examples of standard contract language

Here are a few examples of language that you can tailor for various types of contracts. Note: most service agreements should include additional payment provisions beyond those shown here; these are just the ones involving prepayments.

Website developers

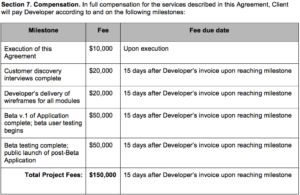

Custom software developers

Graphic designers

These sample clauses are starting points. You can design your payment structure, like most other parts of your relationship with clients, in any way that you and the client can think up. Whatever your policy is, put it in writing and make it clear.